Revolutionizing Engagement with MootUp’s Metaverse

Old Mutual’s Foray into the Future

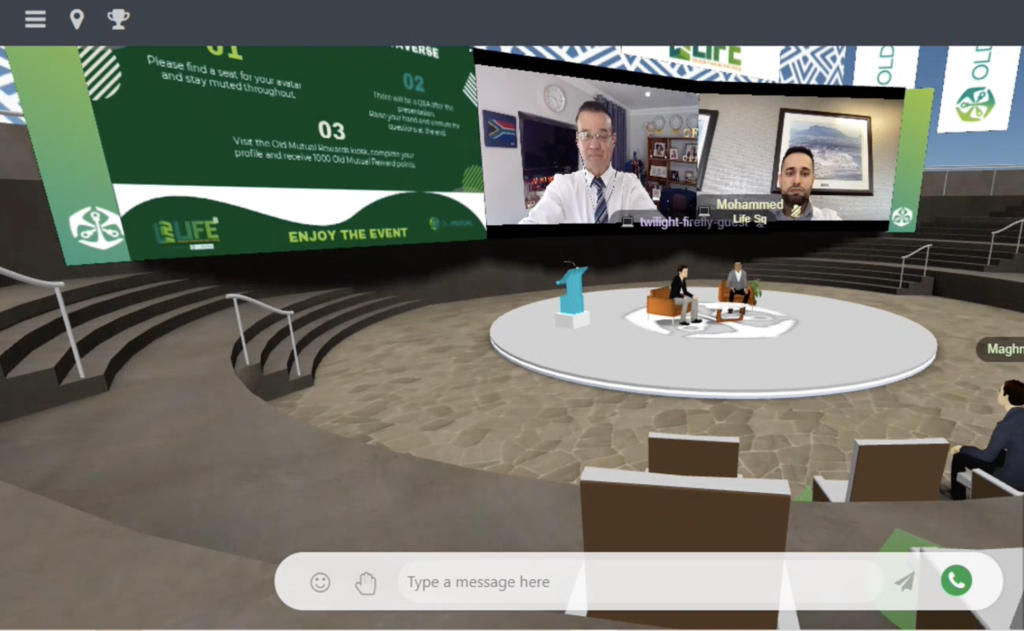

This case study explores Old Mutual‘s innovative venture into the Metaverse, through LifeSquared (Life²), an accredited Old Mutual Agency Franchise- leveraging MootUp’s Metaverse platform to transform the way it engages with employees and customers.

Through a pioneering Metaverse showcase, Old Mutual demonstrated its commitment to digital innovation and set a benchmark in virtual experiences.

The Metaverse Showcase: Old Mutual’s Digital Milestone

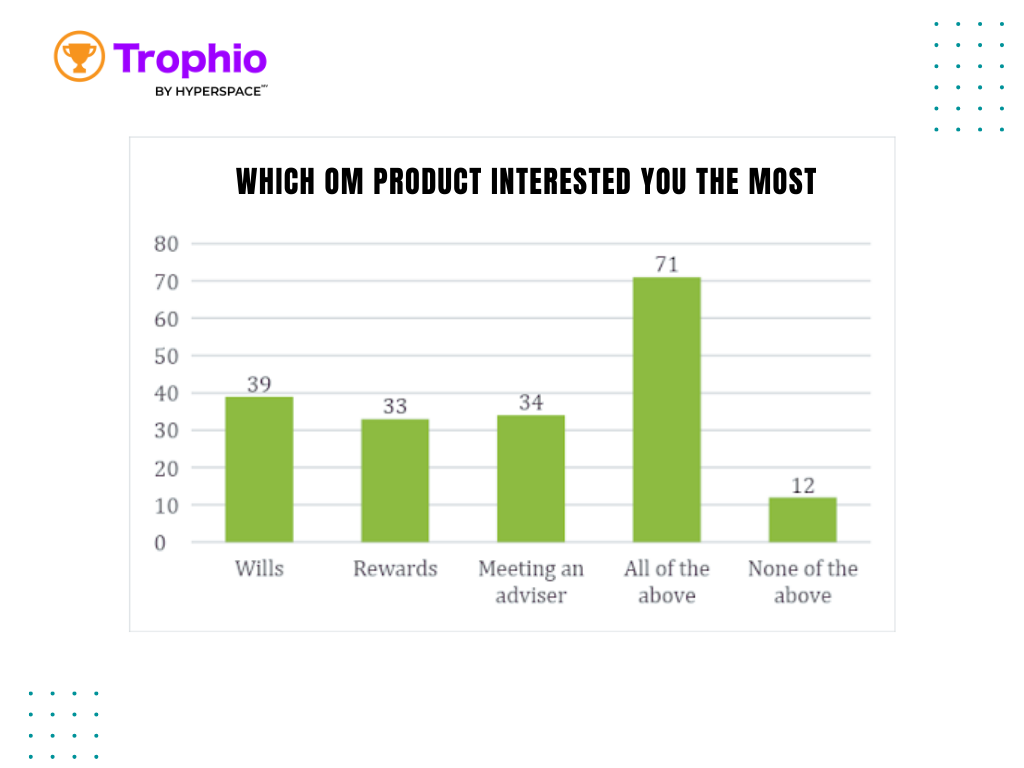

Objective: The Metaverse event experience has multiple objectives starting with immersing Old Mutual employees in a future tech at their doorstep while also user-testing four customer journeys:

- Meet an Adviser in the Metaverse

- Old Mutual Wills lead generation

- Old Mutual Rewards

- Immersive experiences

Approach: In collaboration with Life², an accredited Old Mutual Agency Franchise, Old Mutual created an immersive Metaverse experience that served for the immersive dynamic scenarios or choice-based customer journey experiences as well as for live event sessions and panel discussions held in 3D environments with speakers accessing from the location and device of their choice.

The Benefits of Going Virtual and Using a Metaverse Platform

This venture not only showcased the innovative spirit of Old Mutual but also emphasized the importance of inclusivity and accessibility in today’s interconnected world.

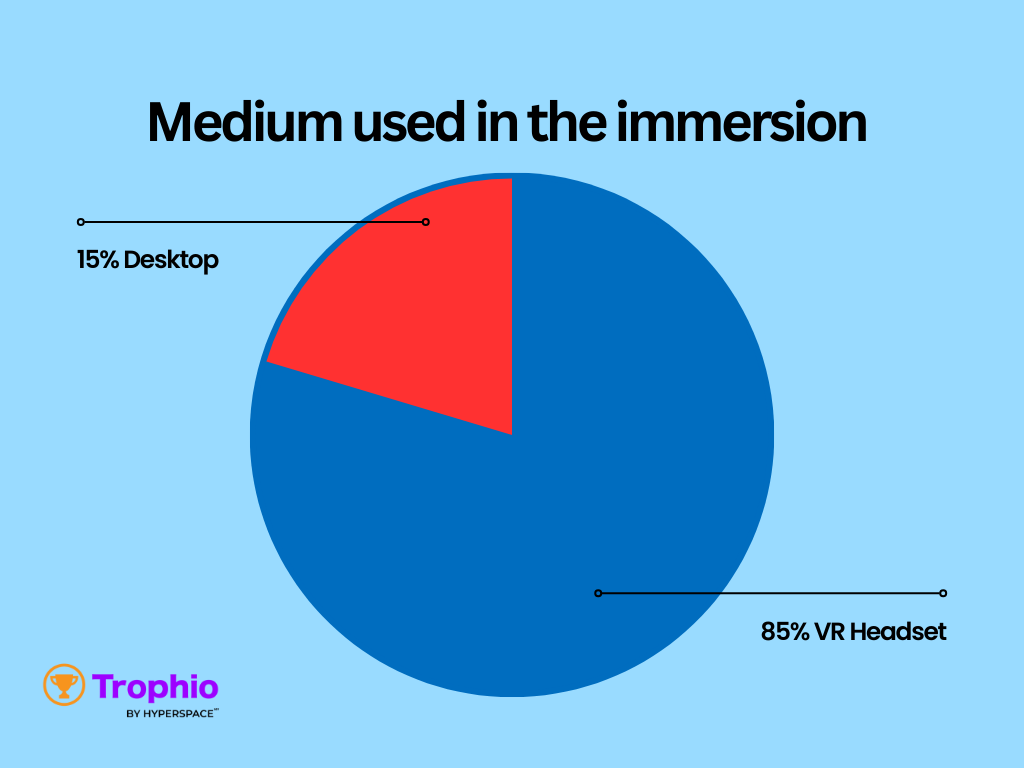

85% Of participants joined using Meta’s VR headsets and 15% used Desktop computers.

Out of everyone using a VR headset 94% rated their experience highly.

It also shows how having the right partners is crucial for a successful event, and Life² and Old Mutual found that MootUp combined an end-to-end solution with a dedicated team of experts perfectly aligned with the vision and goals for the event.

“Several employees were impressed and inspired that Old Mutual is working with a leading-edge and emerging technology.” -Shared Life²

Following this immersive experience, it’s important to highlight the inherent advantages of using a metaverse platform for such events:

- Increased Accessibility: The event’s virtual format, enhanced by Old Mutual’s strategic use of technology, made the experience more accessible. With the assistance of Soapbox Films, various immersive journeys in the metaverse were facilitated.

Cost-Effectiveness: The shift to a digital format typically aligns with more efficient budget allocation and reduced financial overheads. The choice of a metaverse platform inherently suggests a more cost-effective approach to event hosting, minimizing expenses such as physical venues, travel, and accommodation.

Participants highlighted the experience as one that can“provide a solution for virtual training and will replace the need for travel.”

- Scalability: The metaverse platform provided flexibility in accommodating the event’s format and activities. This adaptability allowed for a tailored experience, showcasing the platform’s ability to scale up or down as needed.

- Enhanced Engagement: The immersive and interactive nature of the metaverse kept attendees engaged, enhancing the overall impact of the event.

Engagement has a direct impact on the user experience

“A great majority of participants commented on their experience, commenting that it was innovative, interesting, and exciting.“

- Data and Analytics: Easily collecting and analyzing data is one of the advantages of a virtual experience. The event provided valuable insights into attendee behavior and engagement, aiding in the collection, assessment, and improvement of customer journeys.

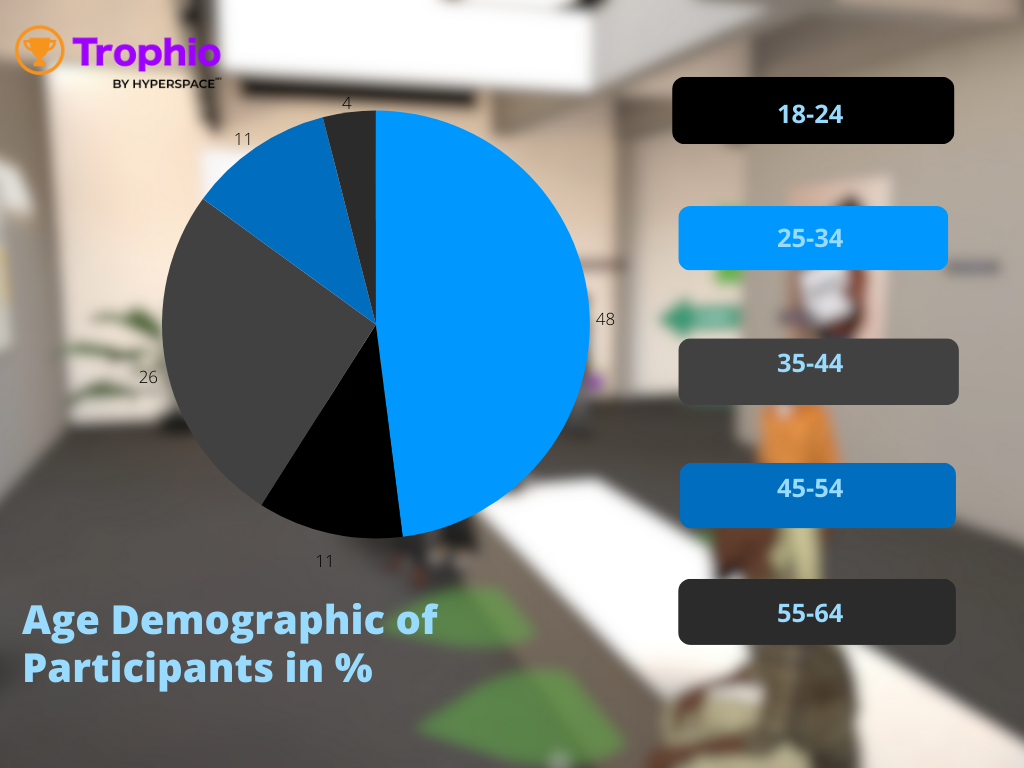

The results are exciting. Everyone who participated in the virtual experiences actually completed the feedback survey.

“98% of the participants who lie in the age range of 35-44 rated their experience highly.”-Shared Life²

- Flexibility and Creativity in Event Design: The metaverse allowed for creative and unique event spaces, tailored to the specific objectives of Old Mutual’s customer journeys.

- Sustainability: The virtual nature of the event aligns with today’s environmental sustainability concerns and goals, minimizing the carbon footprint associated with traditional events.

- Effective Networking: Metaverse platforms inherently offer the potential for effective networking. The 3D immersive elements enable attendees to connect in life-like meaningful and interactive ways, making it a valuable feature in today’s digitilized world.

- Content Longevity: The persistent nature of MootUp environments and experiences extends the event’s content and reach, increasing the life cycle of the experience and its impact beyond the three days.

These benefits not only enhanced the overall experience of the event but also aligned seamlessly with Old Mutual’s goals of showcasing innovation and inclusivity in the digital age

Integrating Hybrid and Metaverse Elements in the 3-day Event

Old Mutual Opted for a smart blend of Metaverse and hybrid event format – allowing those who wanted to and were able, to attend in person.

Using two-way portals to link virtual and physical spaces resulted in several practical benefits:

- Flexible Engagement: Attendees had the option to engage either through VR headsets for a full metaverse experience while also attending in person, accommodating diverse preferences.

- Real-time Interaction: Two-way portals enabled simultaneous interaction between virtual and physical participants, enhancing the event’s dynamism.

- Extended Reach: The hybrid format means those unable to attend physically can still participate, broadening the event’s audience and benefits.

- Tech Integration: The use of Meta VR headsets was a practical demonstration of integrating advanced technology in a real-world setting

- Diverse Feedback: With both in-person and virtual participants, the event captured a wide range of insights, enriching the overall feedback.

- Showcasing Adaptability: Successfully merging hybrid and metaverse elements demonstrates Old Mutual’s capability in versatile event management

Insights and Impact: MootUp Features That Made a Difference

Diving into the mechanics of what made Old Mutual’s Metaverse event a triumph, this section reveals the strategic planning, technology, and innovative approaches that laid the foundation for success.

- Accessibility

MootUp’s dedication to accessibility goes beyond mere ease of access, incorporating advanced features to ensure inclusivity for all participants.

Key accessibility features available for the event:

Captions and Live Translations: Through partner integrations, MootUp provides real-time captioning and live translation services, making the content accessible to a diverse, global audience. This feature is crucial for overcoming language barriers and ensuring that non-native speakers can fully participate and engage.

AI-Driven Translations and Captions: Utilizing AI technology, MootUp offers instantaneous translations and captioning, enhancing comprehension and engagement for participants with different language proficiencies.

- Ease of Access

Any Device from Anywhere. MootUp’s platform was engineered for universal accessibility, allowing users to connect via smartphones, tablets, laptops, and VR headsets without downloads and installations. This feature ensured that regardless of location or device preference, participants could seamlessly join Old Mutual’s event, breaking down geographical and technological barriers.

- Gamification

MootUp includes a fully integrated gamification system to boost engagement and interactivity. This included features like virtual scavenger hunts, quizzes, and reward systems. These tools made the Old Mutual event more interactive and enjoyable, encouraging greater participation and keeping attendees engaged throughout the event.

Life² and Old Mutual offered prizes to participants as they were going through the experience.

- Engagement and Immersion

Addressing one of the objectives Old Mutual had for the event- Immersive Experiences- MootUp’s Metaverse platform offered highly immersive environments that were branded and customized to reflect Old Mutual’s branding and to create environments that would serve the immersive experiences themselves.

The digital spaces served to create and deliver dynamic and interactive experiences. Using AI chatbots and the integration with ChatMapper (a tool for writing and testing nonlinear dialogue and events for fields where complex problems are the normal), Old Mutual was able to deliver life-like scenarios for the 4 customer journey experiences:

- Meet an Adviser in the Metaverse

- Old Mutual Wills lead generation

- Old Mutual Rewards

- Immersive experiences

Each experience had its own separate scenario and gameplay, placing participants in real-life situations, and having to deal with real-world problems and solutions.

- Interoperability

MootUp boasts robust interoperability, seamlessly integrating with over 100 popular tools and platforms. This flexibility ensures that even tools not currently integrated can be easily incorporated, enhancing user convenience and functionality.

- Analytics

MootUp includes comprehensive analytics tools that enable Old Mutual to track attendee engagement, session popularity, and other key metrics. This data was crucial for understanding participant behavior, measuring the success of different event components, and planning future improvements and strategies.

The Future: Expanding Horizons

As a Metaverse for Business platform that is already been used by Fortune 500 companies, including pharmaceuticals, insurance, and banking, MootUp by Hyperspace offers an end-to-end solution for organizations that want to expand in the Metaverse.

Here are a few examples:

Innovative Customer Journeys and Engagements

AI-Powered Interactions: Leveraging integrations with advanced AI platforms such as ChatGPT, Google’s Dialogflow, Meta’s Witt.ai, and RASA, MootUp provides dynamic AI-driven avatars and virtual assistants.

This technology enables AI bots to converse in plain language and engage users in meaningful dialogues. This results in a more intuitive and personalized financial service navigation, offering users tailored recommendations and simplifying complex decisions.

Immersive Learning and Collaboration: At its core, MootUp is enterprise-focused, transcending traditional event platforms. It facilitates immersive simulations and virtual collaborations across various business areas. This includes enhanced training and decision-making processes, along with financial literacy programs. The platform allows organizations to impart valuable insights and experiences to both users and staff, fostering a collaborative and learning-rich environment.

Expanding User Journeys: The potential of Old Mutual’s Metaverse extends far beyond current applications. Future developments could include broadening user journeys and customer use cases, as well as comprehensive financial education initiatives like a “Metaversity.” This concept, drawing on Moneyversity content, aims to create engaging, interactive experiences that bring customer personas, such as the Family Provider and Income Preserver, to life.

Niche Market Awareness: The platform also serves as a key tool in highlighting Old Mutual’s commitment to Environmental, Social, and Governance (ESG) principles and responsible investment practices. It plays a vital role in raising awareness and educating users in these critical areas.

Interactive Training and Events: With its ability to easily integrate in learning management systems (LMS). MootUp can easily become an interactive training platform for customers, advisers, and support staff. It will also facilitate events and live presentations on complex financial topics, enhancing accessibility and engagement.

Technological Advancements and Integrations

The platform’s accessibility and degree of interoperability which enable it to work with other tools and solutions help extend the life cycle of current investments and tools thanks to the fact that employees and staff can still use the same tools, reducing the need for training in new services and cost of new investments – the advantage extends past financial costs, to employee and customer satisfaction and retention.

Futureproof

From the beginning, the platform was built to withstand and adapt to any changes and new technology.

A simple example of this is its existing compatibility with Apple’s Vision Pro headsets to be released in 2024, for example. The platform is in fact compatible and accessible on any device, from tablets, mobile phones, computers, and virtual reality and augmented reality devices without any extra work or costs.

Looking Towards the Future for Old Mutual Metaverse

Old Mutual’s engagement with the Metaverse, using the existing capabilities of the platform, offers several promising avenues for enhanced customer interaction and business operations.

Meet an Adviser

Customer Engagements: The platform can facilitate virtual meetings between advisers and clients, providing a novel and convenient way for both existing and potential customers to receive advice. This capability can lead to increased customer engagement and satisfaction as well as staff development.

Access to Information for Rewards, Wills, and Financial Education

AI-Driven Bots: Offering 24/7 access to information through AI-driven bots, the platform efficiently provides customers with details about various services. This round-the-clock accessibility could significantly improve customer experience and streamline information dissemination.

Hosting of Metaverse Events

Customized Event Hosting: The platform’s ability to host customized events, including branding and administration for both public and private events, presents a unique opportunity for Old Mutual to engage with a broader audience. This is a powerful tool for marketing, community building, and outreach.

Staff Learning and Training

The Metaverse platform can be a powerful tool for staff education and training, offering immersive and interactive learning experiences. These virtual training environments can simulate real-world scenarios, enhancing skill development and knowledge retention. It can also facilitate remote training sessions, making learning more accessible and flexible for employees.

Innovating Engagement: Old Mutual’s Success Story with MootUp’s Metaverse

As we have seen, Old Mutual’s venture into the Metaverse with MootUp revolutionized their engagement strategies, leading to unprecedented levels of interaction and satisfaction. By leveraging the immersive and versatile nature of MootUp’s Metaverse, Old Mutual not only reached but exceeded their engagement goals, setting a new standard for digital workshops.

Are you ready to take your events to the next level? Discover how MootUp can transform your virtual meetings, events and conferences into dynamic, immersive experiences.

Interested in seeing what the Metaverse can do for you? Schedule a free demo of MootUp’s platform today by clicking HERE.

Join the ranks of innovative companies like Old Mutual and redefine the way you engage with your audience. Welcome to the future of interaction—welcome to MootUp’s Metaverse.